Streamlining Success: Payroll Software for UK Small Business Operations

Streamlining Success: Payroll Software for UK Small Business Operations

Running a small business in the UK presents unique challenges. Managing finances is always a top priority. Among these tasks, payroll stands out. It demands precision and compliance. For many UK small businesses, payroll can be a time sink. It can also be a source of stress. This article explores how modern payroll software UK small business tools transform operations. They offer efficiency and peace of mind. Let’s delve into this essential topic.

The Shifting Landscape of UK Small Business Payroll

Payroll management has evolved significantly. Gone are the days of manual calculations. Spreadsheets once dominated. Now, digital solutions are common. UK small businesses face complex regulations. HMRC demands accuracy. Late payments incur penalties. Incorrect tax calculations cause issues. Employees expect timely, correct pay. These factors highlight the need for robust systems. Traditional methods struggle to keep pace. They are prone to human error. They consume valuable time. Small business owners wear many hats. They often lack dedicated payroll staff. This makes efficient tools vital. They need reliable payroll software UK small business solutions. The right software simplifies these complexities. It ensures compliance. It frees up resources.

Understanding the Core of Payroll Software for UK Small Business

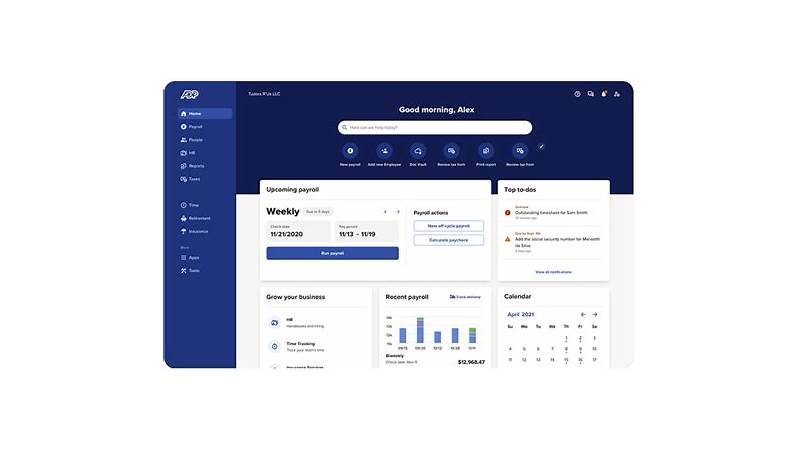

What exactly does payroll software UK small business offer? At its heart, it automates salary processing. This includes wages, bonuses, and deductions. It calculates PAYE tax. It handles National Insurance contributions. Pension auto-enrolment is another key feature. The software integrates with HMRC systems. This allows for direct submissions. RTI (Real Time Information) reporting becomes seamless. Many solutions also manage holiday pay. They track sick leave. Some include expense management. Employee self-service portals are common. These empower staff. They can access payslips and update details. This reduces administrative burden. The software often provides comprehensive reports. These aid financial planning. They support auditing requirements. Choosing the right software is a strategic decision. It impacts financial health. It affects employee satisfaction. It ensures legal compliance.

Key Features Every UK Small Business Needs

When evaluating payroll software UK small business options, look for specific features. First, HMRC compliance is non-negotiable. The software must stay updated. It needs to reflect current tax laws. Auto-enrolment for pensions is crucial. This helps meet legal obligations. RTI submissions should be automated. This simplifies reporting. Clear payslip generation is important. Employees need understandable pay statements. Reporting capabilities are also vital. They provide insights into costs. Integration with accounting software is a huge plus. This creates a unified financial system. Cloud-based access offers flexibility. It allows payroll from anywhere. Security features are paramount. Protecting sensitive employee data is a must. Look for data encryption. Ensure robust access controls. User-friendliness is key. Small business owners are busy. The interface should be intuitive. Support channels are also important. Reliable help saves time and frustration. Consider a free trial. This allows testing before commitment. [See also: Choosing Accounting Software for Your Small Business]

Navigating the Benefits of Modern Payroll Software

The advantages of adopting payroll software UK small business are numerous. They extend beyond mere automation. Let’s explore some significant benefits. For instance, consider accuracy. Manual calculations are error-prone. One mistake can cascade. It affects tax, NI, and net pay. Software eliminates these human errors. It follows predefined rules. This ensures precise calculations. Then there’s time saving. Processing payroll manually takes hours. Software completes the task in minutes. This frees up valuable time. Owners can focus on growth. They can serve customers better. Compliance is another major benefit. HMRC rules change often. Keeping up is a challenge. Good payroll software updates automatically. It ensures adherence to regulations. This avoids costly fines. It prevents legal headaches. Cost efficiency also improves. Outsourcing payroll can be expensive. Hiring dedicated staff adds overhead. Software provides a cost-effective alternative. Many solutions are subscription-based. They offer scalable pricing. Data security is enhanced. Reputable providers use strong encryption. They have secure data centres. This protects sensitive employee information. Reduced stress is a less tangible benefit. Yet, it is profoundly important. Knowing payroll is handled correctly brings peace. It allows for better sleep. Employee satisfaction also increases. Accurate, on-time payments build trust. Self-service portals empower staff. They reduce payroll queries. This improves overall morale. Decision-making improves too. Comprehensive reports offer insights. They show labour costs. They highlight spending patterns. These help with budgeting. They inform strategic choices. For the typical payroll software UK small business user, these benefits are transformative.

Real-World Impact: A Small Business Story

Consider ‘The Daily Grind’ coffee shop. Sarah owns this bustling spot. She used spreadsheets for payroll. Every month was a scramble. Calculating hours was tough. Deductions were confusing. HMRC submissions were stressful. One month, she missed a deadline. A small fine followed. This prompted a change. Sarah researched payroll software UK small business options. She chose a cloud-based solution. The transition was smooth. Now, payroll takes minutes. Employees log their hours. The system calculates everything. Payslips are generated automatically. HMRC submissions are effortless. Sarah no longer dreads payday. She focuses on brewing great coffee. Her staff are happier. They get accurate pay on time. This is a common story. It highlights real impact. Good software empowers small businesses. It lets them thrive. [See also: Maximising Efficiency in Small Business Operations]

Choosing the Right Payroll Software UK Small Business

Selecting the ideal payroll software UK small business requires careful consideration. The market offers many choices. Each has unique strengths. Start by assessing your needs. How many employees do you have? What is your budget? Do you need advanced features? Research reputable providers. Look for strong reviews. Check their track record. Consider scalability. Your business might grow. The software should grow with it. Compare pricing structures. Some charge per employee. Others have tiered plans. Understand what’s included. Hidden fees can be a problem. Look for good customer support. You will inevitably have questions. Quick, knowledgeable help is invaluable. Data security protocols are vital. Ensure GDPR compliance. Read terms and conditions carefully. Take advantage of free trials. Test the software thoroughly. See if it fits your workflow. Ask for demonstrations. Engage with sales representatives. Don’t rush the decision. This is an investment. It will impact your business daily. A well-chosen system pays dividends. It supports long-term success. It simplifies essential tasks. It empowers your UK small business.

Practical Steps to Implementation

Once you choose your payroll software UK small business solution, implementation is next. First, gather all employee data. This includes personal details. P45s, P60s, and bank details are needed. Input this data accurately. Double-check everything. Next, configure company settings. Set up pay frequencies. Define holiday policies. Establish pension schemes. Link to your accounting software if possible. This creates synergy. Train your team if necessary. Show them how to use self-service portals. Explain new processes. Run a parallel payroll. Do this for one or two cycles. Process payroll manually and with the software. Compare results closely. This catches discrepancies. It builds confidence. Finally, go live. Switch entirely to the new system. Stay vigilant for a few months. Monitor for any issues. Provide feedback to the vendor. Continuous improvement is key. This structured approach ensures a smooth transition. It minimises disruption. It maximises the benefits quickly.

Conclusion: The Future is Digital for UK Small Business Payroll

The landscape for UK small businesses is dynamic. Compliance and efficiency are paramount. Manual payroll is no longer sustainable. It is too risky and time-consuming. Modern payroll software UK small business solutions offer a clear path forward. They provide accuracy and automation. They ensure HMRC compliance. They free up valuable resources. They empower business owners. They improve employee satisfaction. Investing in the right software is not an expense. It is a strategic investment. It builds a stronger foundation. It supports growth. It reduces stress. It ensures your business remains competitive. Embrace digital transformation. Secure your financial future. Let technology handle the details. Focus on what you do best. Your UK small business deserves this efficiency. It deserves this peace of mind. Make the smart choice today.