Payroll Software UK Navigating Compliance and Efficiency

Payroll Software UK Navigating Compliance and Efficiency

Running a business in the UK demands precision. Managing payroll is a critical task. It involves much more than just paying staff. UK regulations are complex. HMRC compliance is strict. Many businesses struggle with this burden. This is where payroll software UK becomes essential. It streamlines processes. It ensures accuracy. It helps businesses stay compliant. Understanding its value is key. This article explores why.

The Landscape of UK Payroll Management

Payroll management has evolved greatly. Historically, it was a manual process. Ledgers and calculators were common. Errors were frequent. Time consumption was high. The UK legal framework also changed. New tax codes emerged. Pension auto-enrolment became mandatory. These changes added layers of complexity. Businesses faced growing administrative pressure. Manual systems could not keep up. They became unsustainable. Companies needed a better way. Digital solutions offered relief. This shift made payroll software UK indispensable. It transformed how businesses operate. It offered a path to efficiency.

Consider a small bakery owner, Sarah. She started with paper records. Calculating wages was a weekly headache. Deducting tax was confusing. Pension contributions added more stress. She spent hours on payroll. This took time from baking. Her business suffered. Sarah needed a change. She explored modern options. This led her to discover payroll software UK. Her experience is typical. Many small businesses share it. They seek simpler solutions.

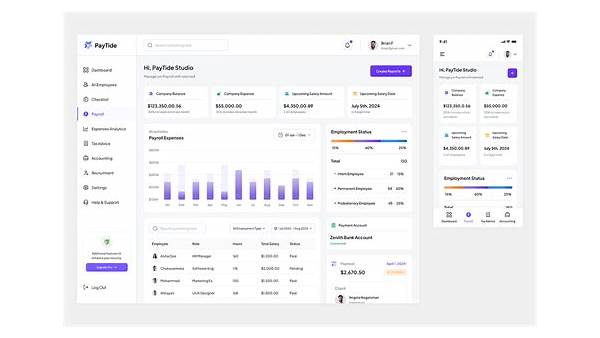

The Core Benefits of Modern Payroll Software UK

Modern payroll software offers many advantages. It automates repetitive tasks. This saves significant time. Accuracy also improves dramatically. Human error reduces greatly. Compliance becomes simpler. HMRC updates are often built-in. This keeps businesses on track. Data security is enhanced. Sensitive employee information stays protected. These are just some key benefits. Let’s explore them further. Compliance assurance is paramount. Efficiency gains are substantial. Cost savings are also possible.

Compliance Assurance with Payroll Software UK

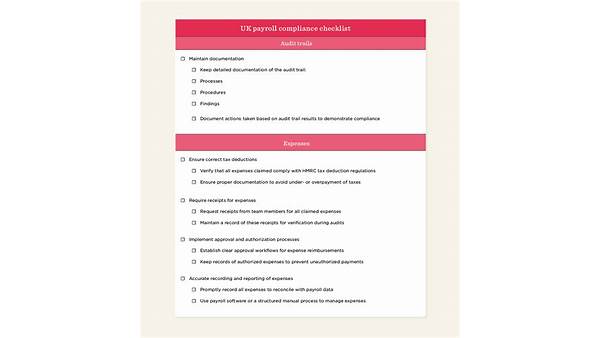

UK payroll rules are ever-changing. HMRC publishes new guidelines frequently. Tax rates adjust. National Insurance contributions vary. Minimum wage laws update annually. Pension auto-enrolment has strict rules. Keeping up manually is nearly impossible. Mistakes lead to penalties. Fines can be costly. Reputational damage is also a risk. Payroll software UK handles this complexity. It automatically applies current tax codes. It calculates National Insurance correctly. It manages pension deductions. It submits data directly to HMRC. This ensures full compliance. Businesses avoid costly errors. They gain peace of mind. [See also: Understanding UK Tax Regulations for Small Businesses]

Boosting Efficiency and Saving Time

Manual payroll is a time sink. Data entry takes hours. Double-checking calculations is tedious. Generating payslips is another task. Imagine a company with 50 employees. This process could take days. Time is money for any business. Payroll software UK streamlines everything. It automates calculations. Payslips generate instantly. Bank transfers can be automated. Reporting becomes effortless. Managers can focus on growth. They spend less time on administration. This boosts overall productivity. It frees up valuable resources. Sarah, the baker, saw this first-hand. Her payroll time shrunk from hours to minutes.

Cost Reduction and Resource Allocation

Hiring a dedicated payroll specialist is expensive. Outsourcing payroll can also be costly. For many small to medium businesses, this is not feasible. Payroll software UK provides an alternative. It empowers internal staff. They can manage payroll efficiently. This reduces the need for external help. It lowers operational costs. Resources can be reallocated. They can support core business functions. This strategic shift benefits profitability. It helps businesses grow smarter.

Choosing the Right Payroll Software UK

The market offers many options. Selecting the best payroll software UK needs careful consideration. Not all solutions are equal. Businesses must assess their specific needs. Size of workforce matters. Industry specific requirements play a role. Budget constraints are also important. Here are some key factors to evaluate. Consider these points carefully.

Scalability and Features

A growing business needs flexible software. Can it handle more employees? Does it integrate with other systems? Accounting software integration is vital. HR management tools are also useful. Look for features like expense management. Time tracking capabilities can be valuable. Auto-enrolment support is non-negotiable. Reporting functions should be robust. Your chosen payroll software UK should grow with you. It should meet future demands.

Ease of Use and Support

The software must be user-friendly. Complex interfaces lead to frustration. Training time should be minimal. A good user experience is crucial. Excellent customer support is also key. What if you encounter an issue? Quick, reliable help is essential. Check for online resources. Look for dedicated support teams. A responsive provider makes a difference. This ensures smooth operations. It minimises downtime.

Security and Data Protection

Payroll data is highly sensitive. It contains personal employee information. Financial details are also present. Robust security measures are paramount. The payroll software UK must comply with GDPR. Data encryption is essential. Multi-factor authentication adds protection. Regular security audits are vital. Choose a provider with a strong security track record. Protect your employees’ data. Protect your business reputation.

Implementing Payroll Software UK Successfully

Integration needs careful planning. A smooth transition is important. Start with data migration. Ensure all employee records are accurate. Test the system thoroughly. Run parallel payrolls for a period. This checks for discrepancies. Provide adequate staff training. Empower your team to use the software. Phased implementation can be beneficial. Don’t rush the process. A successful rollout brings lasting benefits. It maximises your investment. It ensures ongoing efficiency. Communication is also key. Inform employees about changes. Address any concerns promptly. This fosters trust.

The Future of Payroll Software UK

The landscape continues to evolve. Cloud-based solutions are now standard. Mobile access is increasingly common. AI and machine learning will play a bigger role. They will enhance automation further. Predictive analytics might emerge. This could forecast payroll trends. Real-time payments are also on the horizon. Open banking integration will grow. Payroll software UK will become even smarter. It will offer deeper insights. It will simplify compliance further. Businesses must stay updated. Embracing new technology is vital. It secures future competitiveness.

For example, imagine John, a construction firm owner. He already uses advanced payroll software UK. Now, his system integrates with project management. It automatically allocates labour costs. This provides instant profitability insights. He makes better business decisions. This proactive approach is the future. It moves beyond basic compliance. It uses payroll data strategically.

Conclusion Navigating the Modern UK Payroll Landscape

Managing payroll in the UK is no small feat. It demands accuracy, compliance, and efficiency. Manual processes are simply unsustainable. They drain resources. They invite costly errors. Modern payroll software UK offers a powerful solution. It automates complex tasks. It ensures HMRC compliance. It frees up valuable time. It protects sensitive data. Choosing the right system is crucial. It requires careful evaluation. Look for scalability, ease of use, and strong security. Implementing it thoughtfully will yield significant returns. Embrace this technology. It is an investment in your business’s future. It is a pathway to growth. It allows you to focus on what truly matters. Your people. Your customers. Your core mission. The right software empowers you. It builds a stronger, more compliant, and more efficient operation. Make the smart choice today.