Streamlined Payroll Your Essential Guide to PAYE Software UK

Streamlined Payroll Your Essential Guide to PAYE Software UK

Running a business in the UK involves many responsibilities. One critical task is managing payroll. This includes Pay As You Earn (PAYE) deductions. Choosing the right PAYE software UK is vital. It ensures compliance and efficiency. This guide explores everything you need. We focus on effective payroll management. You will gain valuable insights. Understand the best tools available. Make informed decisions for your business. Good software saves time and money. It also avoids costly penalties. Let’s delve into the world of UK payroll.

Understanding the UK Payroll Landscape

The UK payroll system is complex. HMRC sets strict rules. Businesses must follow these regulations. PAYE is central to this system. It deducts income tax and National Insurance. These are taken directly from employee wages. Employers then pay these to HMRC. Getting it wrong can be expensive. Fines and penalties are common. Manual payroll processing is risky. It is also very time-consuming. Many businesses find it overwhelming. This is where PAYE software UK steps in. It automates much of this work. It ensures accuracy and compliance. Understanding the basics is key. You can then appreciate software benefits. [See also: HMRC Payroll Obligations for Employers]

Historically, payroll was a manual ledger task. Accountants spent hours on calculations. Errors were frequent and hard to trace. The digital age changed everything. Software brought significant improvements. Real Time Information (RTI) was a major shift. Employers must report payroll information. This happens on or before payment day. This increased the need for robust systems. Modern PAYE software UK handles RTI effortlessly. It submits data directly to HMRC. This reduces administrative burden. It gives businesses peace of mind. The evolution continues with new features. Staying updated is important for all. Smart tools are now indispensable. They make payroll manageable for everyone.

The Core Functionality of PAYE Software UK

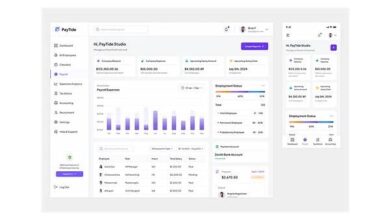

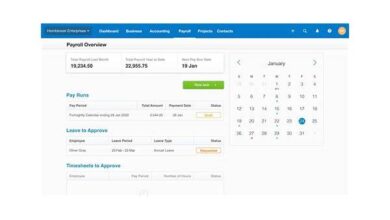

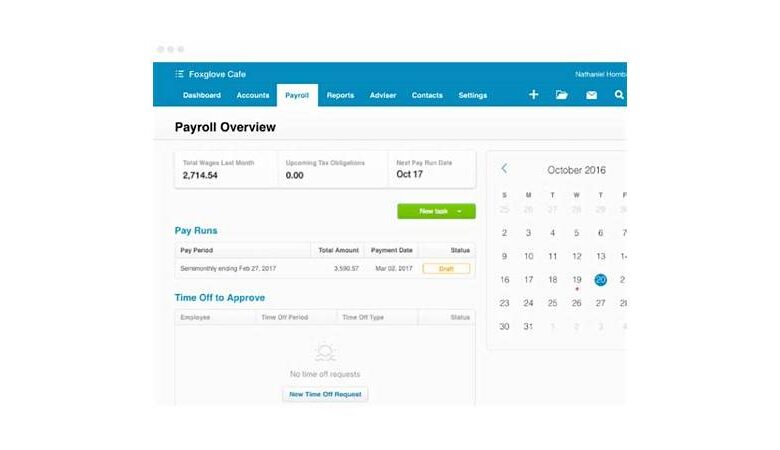

Modern PAYE software UK does much more. It isn’t just about tax deductions. It manages the entire payroll cycle. Key features streamline operations. This includes calculating gross pay. It handles all statutory deductions. Think National Insurance and student loans. Pensions auto-enrolment is also covered. The software computes net pay accurately. It generates payslips for employees. These can be digital or printed. HMRC submissions are automated. Full Payment Submissions (FPS) are sent. Employer Payment Summaries (EPS) are too. This ensures timely reporting. Imagine Sarah, a small business owner. She used to spend days on payroll. Now, her PAYE software UK completes it quickly. It frees her to focus on growth. This efficiency is invaluable. It transforms how businesses operate. Good software becomes a trusted partner.

Essential Features to Look For

- Automated Calculations: This is a fundamental feature. The software calculates tax and NI. It handles statutory sick pay (SSP). Statutory maternity pay (SMP) is also included. Accuracy is paramount for compliance.

- HMRC Reporting: Direct submission to HMRC is crucial. It ensures RTI compliance. FPS and EPS are sent seamlessly. This avoids manual upload errors.

- Payslip Generation: Professional payslips are created. These are clear and easy to understand. Employees can access them securely. This improves transparency.

- Auto-Enrolment Management: Workplace pensions are mandatory. The software manages pension contributions. It handles scheme enrolment. This simplifies a complex area.

- Employee Self-Service: Some systems offer portals. Employees can view payslips. They can update personal details. This reduces HR queries.

- Integration Capabilities: Look for integration options. It should link with accounting software. This creates a unified financial system. It minimizes data entry.

- Reporting and Analytics: Detailed reports are vital. They help track payroll costs. They aid in financial planning. Data-driven decisions become possible.

- Data Security: Payroll data is sensitive. The software must protect it. Look for robust security measures. Compliance with GDPR is essential.

Choosing the right PAYE software UK means evaluating these features. Not all software is equal. Different businesses have different needs. A small startup might need basic tools. A larger firm requires advanced features. Consider your specific requirements carefully. Invest time in research. This upfront effort pays dividends. It ensures long-term success. The right choice empowers your team.

Practical Steps for Selecting PAYE Software UK

Selecting PAYE software UK requires careful thought. It is a significant business decision. Here are practical steps to guide you. Start by assessing your business needs. How many employees do you have? What is your budget? Do you need advanced features? Consider future growth too. A scalable solution is always better. Look at user reviews and testimonials. They offer real-world insights. A free trial can be very useful. Test the software thoroughly. See if it fits your workflow. Support is another key factor. Good customer service is invaluable. [See also: Comparing Top Payroll Software Providers]

Implementation and Ongoing Management

- Define Your Requirements: List all essential features. Include any desired functionalities. This creates a clear roadmap.

- Research Options: Explore various PAYE software UK providers. Compare their offerings. Look at pricing structures carefully.

- Request Demos/Trials: Hands-on experience is vital. Try out a few shortlisted options. See how intuitive they are.

- Check for HMRC Recognition: Ensure the software is HMRC recognised. This guarantees compliance. It gives added confidence.

- Consider Training and Support: Will your team need training? What kind of support is offered? Prompt assistance is important.

- Review Security Features: Data protection is non-negotiable. Understand their security protocols. Ensure GDPR compliance.

- Plan for Integration: How will it integrate with existing systems? A smooth transition is crucial. Avoid data silos.

- Implement and Train: Once chosen, set up the software. Train your payroll team thoroughly. Provide ongoing support.

- Stay Updated: HMRC rules change frequently. Your PAYE software UK must update too. Ensure automatic updates are available.

Implementing new software can seem daunting. With proper planning, it’s smooth. Many providers offer migration assistance. They help transfer existing data. This reduces initial setup stress. Regular reviews are also beneficial. Ensure the software still meets needs. Business requirements can evolve. The market also offers new innovations. Keep an eye on emerging trends. Your payroll system should grow with you.

The Future of Payroll and Your Business

The landscape of payroll is always changing. Technology continues to advance rapidly. Artificial intelligence (AI) is impacting systems. Machine learning improves accuracy. Predictive analytics can forecast costs. Cloud-based PAYE software UK is now standard. It offers flexibility and accessibility. Teams can work from anywhere. Mobile payroll apps are also growing. They provide on-the-go management. Staying adaptable is key. Businesses must embrace new tools. This ensures they remain competitive. It also keeps them compliant. The right software is an investment. It secures your financial operations. It empowers your workforce.

Consider the broader impact too. Efficient payroll boosts employee morale. Accurate and timely payments are expected. Good software fosters trust. It reflects a professional organization. Moreover, it provides valuable data. This data informs strategic decisions. It helps manage cash flow better. It identifies cost-saving opportunities. The benefits extend beyond compliance. They touch every part of your business. Your choice of PAYE software UK matters. It truly shapes your future. Choose wisely, and thrive.

Conclusion Navigating Payroll with Confidence

Managing payroll in the UK is a core business function. It demands precision and compliance. PAYE software UK offers the ideal solution. It automates complex tasks. It ensures accurate calculations. It handles HMRC submissions effortlessly. From small startups to large enterprises, it provides benefits. Choosing the right system involves research. Look for essential features. Consider scalability and support. The right software empowers your business. It saves time and reduces stress. It minimizes the risk of penalties. Invest in a robust PAYE software UK. It is an investment in your company’s future. Embrace technology for efficiency. Unlock true business potential. Step into a world of confident payroll management.