Mastering Payroll Compliance: Your Guide to PAYE Software UK

Mastering Payroll Compliance: Your Guide to PAYE Software UK

Running a business in the UK involves many responsibilities. One critical area is payroll. Managing employee wages and deductions requires precision. This is where PAYE software UK becomes indispensable. It simplifies complex tasks. Choosing the right solution is not just an option. It is a business necessity. This article explores everything about PAYE software UK. We will cover its importance. We will discuss how it benefits your operations. We aim to make payroll simpler for you.

The Foundation: Understanding PAYE in the UK

PAYE stands for Pay As You Earn. It is HMRC’s system. Employers use it. They collect income tax. They also collect National Insurance. These are taken from employee salaries. This happens before payment. It applies to most employees. The UK payroll landscape is dynamic. Rules change frequently. Keeping up can be challenging. Manual calculations risk errors. Errors can lead to penalties. HMRC takes compliance seriously. This system ensures government revenue. It also protects employee rights. A robust understanding is key.

Why PAYE Software UK is More Than Just a Tool

Historically, payroll was a manual affair. Accountants spent hours calculating. Paper records were common. Today, that approach is unsustainable. Businesses need efficiency. They require accuracy. PAYE software UK offers both. It automates calculations. It handles tax codes. It manages National Insurance contributions. It processes student loan deductions. It also tracks statutory payments. These include sick pay and maternity pay. This automation saves time. It reduces human error. This is a huge advantage. It ensures compliance too.

Consider a small business owner. Sarah runs a boutique. She has five employees. Manual payroll was a headache. She spent weekends on it. Mistakes were frequent. Then she adopted a PAYE software UK solution. Her weekends became free. Her payroll became flawless. This is a common story. Growth often demands such solutions.

Navigating the Landscape of PAYE Software UK

The market for PAYE software UK is vast. Many providers exist. Each offers different features. Some cater to small businesses. Others suit larger enterprises. Understanding your needs is vital. Do you need basic functionality? Or advanced reporting? Scalability is also a factor. Your business may grow. Your software should grow with it. Cloud-based solutions are popular. They offer flexibility. On-premise options still exist. They suit specific needs. Reviewing options carefully is crucial.

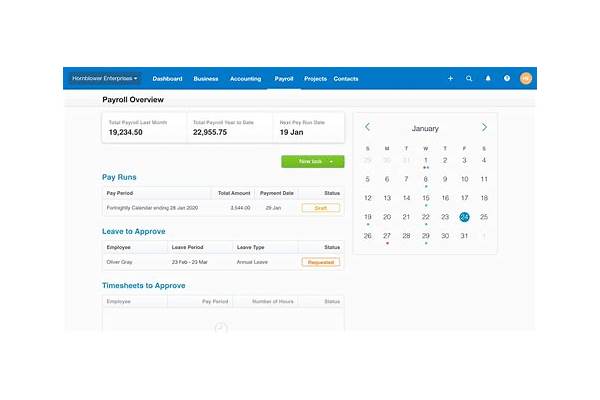

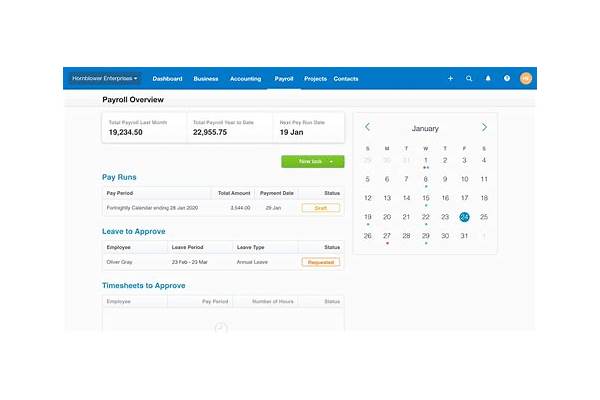

Key Features to Look for in PAYE Software UK

- HMRC Recognition: Ensure the software is HMRC recognised. This guarantees compliance. It means it meets strict standards.

- RTI Submissions: Real Time Information (RTI) is mandatory. The software must facilitate instant submissions. This keeps HMRC updated.

- Auto-Enrolment: Pension auto-enrolment is complex. Good PAYE software UK integrates this process seamlessly. It manages contributions and communications.

- Employee Self-Service: Employees can access payslips. They can update personal details. This reduces HR workload.

- Reporting Capabilities: Comprehensive reports are essential. They help with financial planning. They aid in audits.

- Integration Options: Can it integrate with accounting software? This creates a unified financial system. It streamlines workflows.

- Data Security: Payroll data is sensitive. The software must offer robust security. This protects employee information.

Choosing the best PAYE software UK involves due diligence. Read reviews. Request demos. Speak to other businesses. Their experiences offer valuable insights. [See also: Choosing the Right Accounting Software for Your UK Business]

The Benefits of Implementing Modern PAYE Software UK

The advantages extend beyond compliance. Modern PAYE software UK transforms payroll. It impacts overall business health. Consider the time saved. Manual processes are slow. Automation dramatically cuts hours. This frees up staff. They can focus on strategic tasks. Accuracy is another major benefit. Software minimises human error. This reduces costly mistakes. It avoids HMRC penalties. Financial penalties can be severe. Reputational damage is also a risk. Good software prevents this. It ensures peace of mind.

Enhanced Efficiency and Cost Savings

Efficiency gains are immediate. Data entry is reduced. Calculations are instant. Submissions are automated. This translates directly to cost savings. Less staff time is spent on payroll. This reduces administrative overheads. You can reallocate resources. Focus on growth initiatives instead. Furthermore, cloud-based PAYE software UK often comes with subscription models. This avoids large upfront costs. It provides predictable expenses. This helps with budgeting. Many businesses find this appealing.

Take John’s construction company. He used to pay an external payroll service. It was expensive. He switched to in-house PAYE software UK. The monthly savings were substantial. The control over his data improved. This decision boosted his bottom line. It also increased his operational transparency.

Improved Compliance and Data Security

HMRC regulations are complex. They are constantly evolving. Staying compliant is a full-time job. PAYE software UK keeps you updated. It incorporates the latest tax rules. It ensures correct deductions. This mitigates compliance risks. Automated updates are key. They provide continuous adherence. Data security is paramount. Employee personal data is sensitive. Reputable software providers invest heavily in security. They use encryption. They implement secure access protocols. This protects against breaches. It maintains trust with employees.

Practical Steps for Adopting PAYE Software UK

Implementing new software needs a plan. Hasty decisions can cause issues. A structured approach ensures success. Start by assessing your current process. Identify pain points. Determine your specific requirements. Consider your business size. Think about future growth plans. Research different providers. Compare features and pricing. Look for customer support quality. A smooth transition is achievable.

Migration and Training for Your Team

- Data Migration: Transfer existing employee data. Ensure accuracy during this step. Many software providers offer migration tools.

- User Training: Train your payroll staff. Ensure they understand the new system. Provide ample support resources.

- Parallel Run: Consider running old and new systems concurrently. Do this for one payroll cycle. This identifies any discrepancies.

- HMRC Registration: Update your HMRC details. Inform them of your new software usage. This ensures seamless communication.

- Ongoing Support: Choose a provider with excellent support. You will need help occasionally. Fast, reliable assistance is invaluable.

The transition might seem daunting. However, the long-term benefits outweigh initial efforts. Investing in good PAYE software UK is investing in your business’s future. It’s an investment in efficiency. It’s an investment in compliance. It is also an investment in peace of mind. Your employees will appreciate accurate payslips. Your finance team will thank you for streamlined processes.

The Future of Payroll: Trends in PAYE Software UK

The world of work is changing. So too is payroll. Emerging trends shape PAYE software UK. Cloud technology continues to dominate. Its flexibility is unmatched. AI and machine learning are gaining traction. They offer predictive analytics. They can identify potential errors. API integrations are becoming standard. They create interconnected systems. This ecosystem approach is powerful. Payroll becomes part of a larger, smarter network. Mobile accessibility is also growing. Managing payroll on the go is now possible. This caters to modern business needs.

Embracing Innovation for Smarter Payroll Management

Future PAYE software UK will be even more intelligent. It will offer deeper insights. It will further reduce manual intervention. Imagine a system that flags anomalies. It could suggest optimisations. This moves payroll beyond mere processing. It makes it a strategic asset. Businesses that embrace these innovations will thrive. They will gain a competitive edge. They will ensure absolute compliance. They will empower their workforce.

For example, some advanced PAYE software UK now offers integrated HR functions. This creates a holistic employee management system. From onboarding to offboarding, everything is connected. This streamlines operations significantly. It enhances the employee experience. Staying informed about these trends is important. It helps future-proof your payroll strategy. [See also: The Impact of AI on Business Operations in the UK]

Conclusion: The Indispensable Role of PAYE Software UK

In conclusion, managing payroll in the UK is a complex task. It demands accuracy and strict compliance. PAYE software UK is not merely an administrative tool. It is a strategic asset. It streamlines operations. It ensures regulatory adherence. It mitigates financial risks. From small startups to large corporations, its value is undeniable. Investing in the right solution empowers your business. It frees up valuable time. It ensures your employees are paid correctly. It secures your standing with HMRC. Make an informed choice today. Embrace the power of modern PAYE software UK. Your business, your employees, and your peace of mind will benefit greatly. The journey to effortless payroll starts here.