Choosing the Right Accounting Software in UK for Business Growth

Choosing the Right Accounting Software in UK for Business Growth

Modern businesses demand efficiency. Gone are the days of manual ledgers. Digital solutions now dominate. This is especially true for financial management. Selecting the right accounting software in UK is crucial. It impacts daily operations. It affects long-term success. Understanding your options is vital. This guide will help navigate choices. It focuses on the unique UK market. Your business deserves smart financial tools.

The landscape of UK business is evolving. Digital transformation is everywhere. Compliance requirements are strict. Making Tax Digital (MTD) is a prime example. Businesses must adapt quickly. Robust accounting software in UK is no longer a luxury. It is a fundamental necessity. It ensures accuracy. It saves valuable time. It provides critical insights. Smart choices lead to growth.

The Digital Shift in UK Accounting

For centuries, accounting was manual. Ledgers filled with ink. Calculations were done by hand. Errors were common. Time consumption was immense. The digital age changed everything. Computers brought new possibilities. Spreadsheets offered automation. Dedicated software emerged. This revolutionised financial tasks. Businesses became more agile. Data became accessible.

The UK has been at the forefront. Innovation drives change here. Regulatory bodies also push for it. HMRC’s MTD initiative is significant. It mandates digital record-keeping. It requires digital tax submissions. This applies to VAT-registered businesses. Soon it will extend further. This shift makes accounting software in UK indispensable. Firms must comply. They need reliable tools. Manual methods are no longer sufficient. Digital transformation is key.

Many businesses now embrace cloud technology. This offers flexibility. It provides remote access. Data is secure off-site. Collaboration becomes easier. Accounting teams can work anywhere. Business owners stay informed. This digital shift offers huge advantages. It truly empowers businesses. It streamlines financial processes.

Understanding Accounting Software in UK: Core Benefits and Features

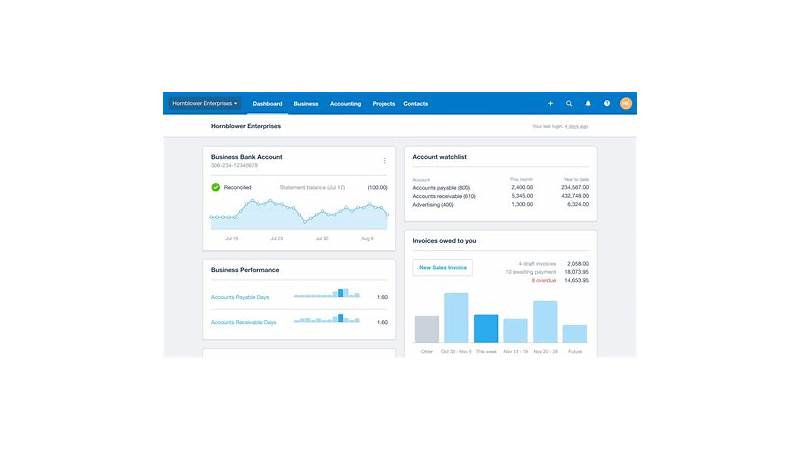

What exactly does accounting software in UK offer? Its benefits are extensive. They touch every part of a business. Efficiency is a major gain. Tasks automate quickly. Data entry reduces significantly. Reconciliation becomes simpler. This frees up staff. They can focus on strategic work. Accuracy also improves greatly. Human errors minimise. Calculations are precise. Financial reports are reliable.

Key features vary by platform. Most software includes core functions. These cover invoicing and billing. Expense tracking is standard. Bank reconciliation is common. Reporting tools are essential. They provide financial statements. Profit and loss reports are crucial. Balance sheets show overall health. Cash flow statements are vital. These reports offer deep insights.

Compliance is another huge benefit. Good accounting software in UK keeps up. It adheres to HMRC regulations. It simplifies VAT returns. MTD submissions are integrated. This reduces compliance stress. It helps avoid penalties. Payroll management can also integrate. This streamlines employee payments. It handles tax deductions correctly. Time is money for businesses.

The Power of Cloud vs. On-Premise Solutions

The choice between cloud and on-premise is important. Cloud-based software is very popular. It is hosted online. Access happens via a web browser. No installation is needed. Updates are automatic. Data backups are managed remotely. This offers great flexibility. It suits remote teams well. Initial costs are often lower. Subscriptions are common.

On-premise software installs locally. It runs on your computers. Data resides on your servers. This offers full control. Security is managed internally. It can be more costly upfront. IT infrastructure is necessary. Updates are manual. Some businesses prefer this control. They have specific security needs. This is less common now. The trend favours the cloud.

For many UK businesses, cloud is the answer. It scales easily. It integrates with other apps. CRM systems can connect. E-commerce platforms link up. This creates a unified ecosystem. It enhances overall business operations. The right accounting software in UK supports this.

Spotlight on Automation and AI in UK Accounting

Automation is changing accounting. Repetitive tasks disappear. Data entry is automated. Bank feeds import transactions. Rules can categorise spending. This saves immense time. It reduces human error. Artificial intelligence (AI) takes this further. AI can detect anomalies. It flags potential fraud. It predicts future cash flow. This offers proactive insights.

Machine learning improves processes. It learns from past data. It refines categorisation. It optimises expense management. These technologies are not future concepts. They are here now. Many accounting software in UK platforms incorporate them. Businesses gain a competitive edge. They make smarter financial decisions. [See also: The Future of Business Finance: AI Integration]

Choosing Your Accounting Software in UK: Practical Steps

Selecting the ideal accounting software in UK requires thought. It is a significant investment. Rushing the decision can be costly. Follow these practical steps. They will guide your choice. Ensure it fits your unique needs.

- Assess Your Business Needs: What are your core requirements? Do you need invoicing? Payroll? Inventory management? Consider your industry. Small businesses differ from large ones. Your current accounting pain points matter.

- Consider Your Budget: Software costs vary widely. Some offer free tiers. Others have monthly subscriptions. Annual plans can save money. Factor in training costs too. Choose a solution you can afford long-term.

- Check for UK Compliance: This is non-negotiable. The software must handle MTD for VAT. It should support UK tax laws. Payroll features must follow HMRC rules. This ensures legal operation.

- Evaluate User-Friendliness: Will your team use it easily? A complex interface frustrates users. Look for intuitive design. A good user experience is key. It boosts adoption rates.

- Look for Integration Capabilities: Does it connect with other tools? CRM, e-commerce, banking apps? Seamless integration avoids data silos. It creates a unified workflow. This saves time and effort.

- Scalability for Growth: Will it grow with your business? A solution for a startup might not suit a growing SME. Ensure it can handle increasing transactions. Look for flexible pricing plans.

- Customer Support and Training: Good support is invaluable. What help is available? Phone, email, chat? Are training resources provided? Online tutorials are very helpful. Ensure reliable assistance.

- Utilise Free Trials: Most providers offer trials. Take advantage of them. Test the software thoroughly. See if it meets your expectations. Get feedback from your team.

Conclusion: Empowering Your Business with the Right Accounting Software in UK

The right accounting software in UK is a powerful asset. It moves businesses forward. It ensures compliance. It boosts efficiency. It provides valuable insights. The digital transformation is here. Embracing it is crucial. Making a well-informed choice empowers your business. It sets you up for future success. Do your research diligently. Consider all your options. Invest in a solution that fits perfectly. Your financial health depends on it. The journey might seem daunting. But the rewards are immense. Choose wisely for sustained growth. Your business will thank you for it.